Market Data Setup

Define all rates and prices imported from market data supplier needed to perform fixing and market valuations. Index, FRA, Swap interests and currency basis spreads. Normally this is already pre-defined for some currencies (the most common) when the system is delivered.

Here you also define credit spread curves that you want to use for market valuation of your debt or asset portfolio.

Se also Combined curves

Curve definition

Choose the market data that should build up the different curves that should be used when doing market valuation of the instrument.

Example:

"Ibor" rates up to 6 months

FRA rates from 6 months – 2 years

Swap interest rates from 2 years – 15 years

Index

Used for Interest rates with tenor less than one year. Index is also used for spread curves.

Name- Name of the index is a free text field and will be shown in Deal input

Description- Free text field

Currency- The currency from which the index is derived

Tenors Value - The different tenors that are available for the index or spread curve.

Lookback - The number of business days locked back for the rate fixing, for example for a Wednesday the fixing day would be the previous Wednesday with a 5 day lookback. Assuming no other bank holidays. This also means that if you have different agreements/instruments with different lookback's you will need to register several indices.

Last Day of Period - Used for calculating the end date (pillar date) for the period in the curve.

Day Convention - This information is gathered from information under currency.

Date Rolling Behaviour - When generating the curve how to treat days

Interest form - describes which form the imported interest rates are in. 'Not set' equals Simple.

Compound In Arrears -Tick this box to calculate the interest amount as compounded. This is standard with the ibor transition, which you can read more about following this link. IBOR transition

All imported interest rates are converted to Simple rates by Treasury systems and then used in calculations.

Adjustments of imported rates

Possible to define adjustment settings for imported market data

Interest adjustment (IA) - enter as a number (system.decimal)

Interest adjustment decimals (IAD) - Number of decimals for the nominal interest rate used on the transaction.

Operator (OP) - Add, Subtract, Multiply or Divide

Example 1: Market rate = 3%, IA = 1,013889, IAD = 6, OP = Multiply -> 0,03 * 1,013889 = 0,03041667 rounded to 3,0417%

Example 2: Market rate = 3%, IA = 0,00324, IAD = 4, OP = Add-> 0,03 + 0,00324= 0,03324 rounded to 3,32%

Example of a credit spread curve

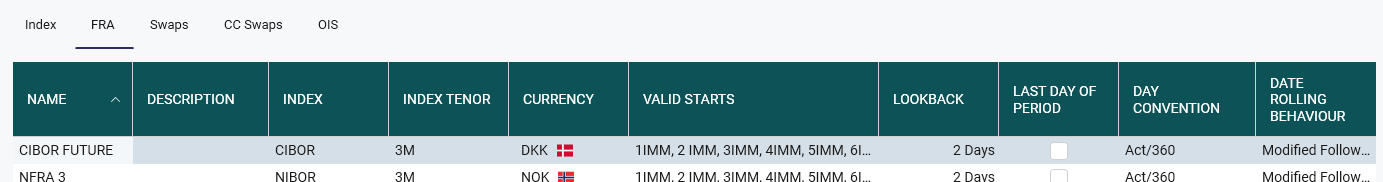

FRA

Used for interest rates on a medium horizon

Name- Name of the index is a free text field and will be shown in Deal input

Description- Free text field

Index - The Index from which the FRA is derived

Index Tenor - The tenor for the FRA

Currency- The currency from which the FRA derived

Valid starts - Number of contracts needed

Lookback - The number of business days from today for the earliest date of the curve. (spot date)

Last Day of Period - Used for calculating the end date (pillar date) for the period in the curve.

Day Convention - This information is gathered from information under currency.

Date Rolling Behavior - When generating the curve how to treat days

Swaps

Used for rates longer than 1 year

Name- Name of the index is a free text field and will be shown in Deal input

Description- Free text field

Payment Period - Borde den ligga under fixed leg?

Valid Durations - The different tenors that are available or of interest for the index

Index - The Index from which the Swap rate is derived

Currency- The currency from which the index is derived

Index Tenor - the maturity for the index

Last Day of Period - Used for calculating the end date (pillar date) for the period in the curve.

Day Convention - This information is gathered from information under currency.

Date Rolling Behavior - When generating the curve how to treat days

Lookback - The number of business days from today for the earliest date of the curve. (spot date)

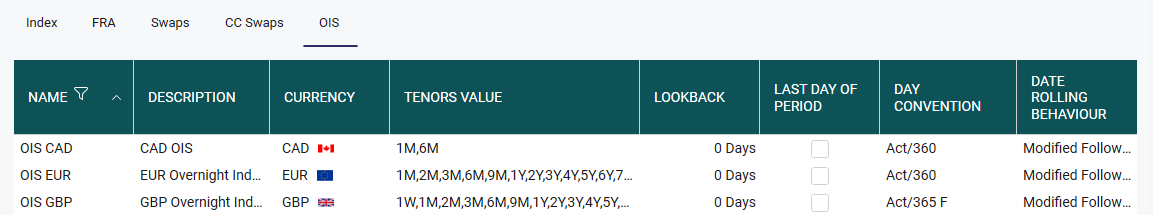

OIS

Name- Name of the index is a free text field and will be shown in Deal input

Description- Free text field

Currency- The currency from which the index is derived

Tenors Value - The different tenors that are available or of interest for the index

Lookback - The number of business days from today for the earliest date of the curve. (spot date)

Last Day of Period -Used for calculating the end date (pillar date) for the period in the curve.

Day Convention - This information is gathered from information under currency.

Date Rolling Behavior - When generating the curve how to treat days

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article